Money management is one of the most important life skills, yet many people are never formally taught how to handle their finances. From paying bills to saving for future goals, the way you manage money affects your daily comfort, long-term stability, and peace of mind. This beginner-friendly guide explains what money management really means, why it matters, and how you can start improving your financial habits step by step.

Understanding the Core Concept of Money Management

Money management refers to the process of planning, organizing, controlling, and monitoring your financial resources. It includes how you earn, spend, save, invest, and protect your money. In simple terms, it is about making conscious decisions instead of letting money control your life.

For example, when someone tracks their monthly expenses, sets a savings goal, and avoids unnecessary debt, they are practicing money management. On the other hand, ignoring bills, overspending on credit cards, or having no savings plan often leads to financial stress.

Why Money Management Matters in Everyday Life

Good money management helps you:

- Pay bills on time and avoid late fees

- Reduce financial stress and anxiety

- Build emergency savings

- Prepare for future goals like education, travel, or retirement

- Make informed financial decisions

Consider a simple real-life scenario. Two people earn the same monthly income. One plans expenses, saves regularly, and limits debt. The other spends without tracking and relies on credit. Over time, their financial outcomes become very different, even though their income is the same. This difference is created by money management, not income alone.

Key Components of Money Management

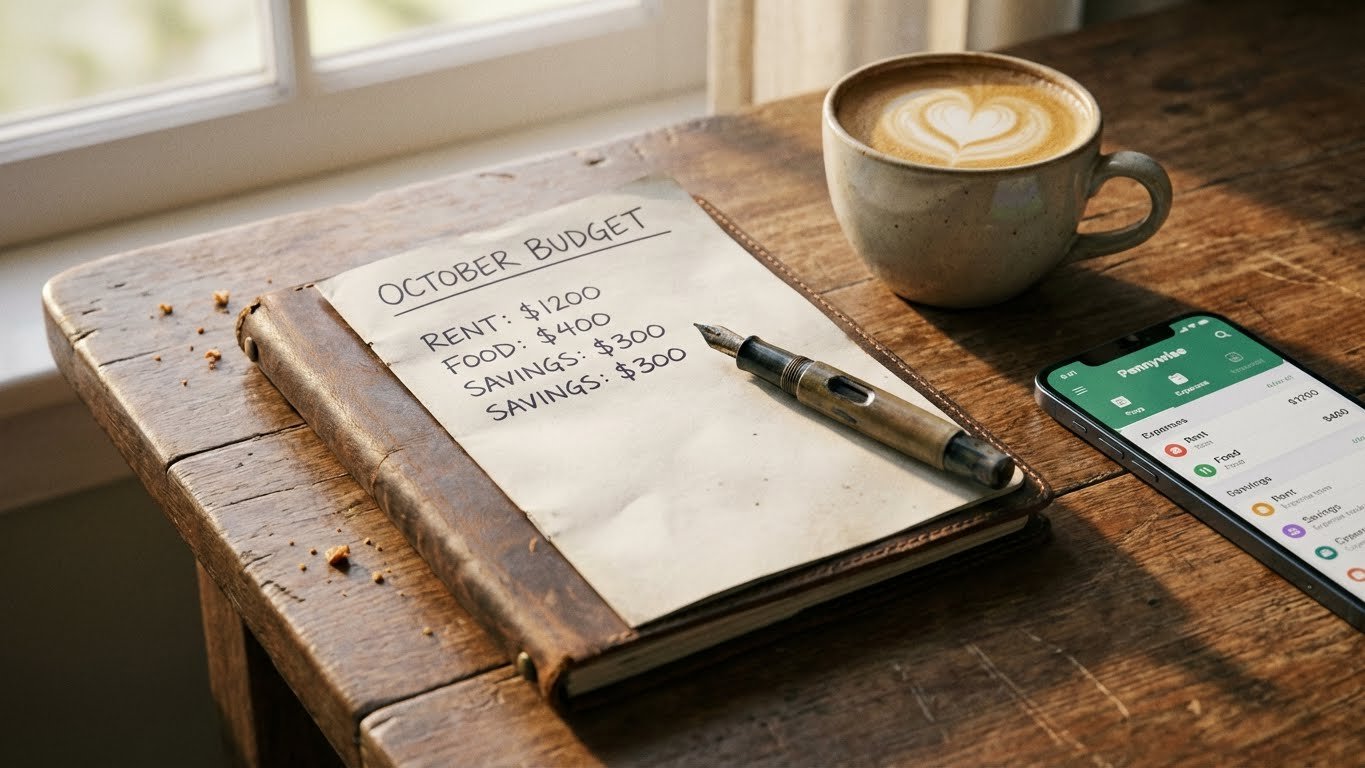

1. Budgeting

Budgeting is the foundation of money management. It means assigning your income to specific categories such as housing, food, transport, savings, and entertainment. A budget does not restrict you; it gives you control.

2. Saving

Savings provide financial security. Emergency funds, short-term savings, and long-term savings all serve different purposes. Even small, regular contributions can grow into meaningful financial support over time.

3. Spending Control

Spending wisely does not mean avoiding enjoyment. It means prioritizing needs over wants and making conscious purchase decisions.

4. Debt Management

Debt can be useful or harmful depending on how it is handled. Managing interest rates, repayment schedules, and credit utilization is a crucial part of money management.

5. Financial Planning

Planning includes setting goals, estimating future costs, and preparing for financial responsibilities such as education, healthcare, or retirement.

Practical Money Management Examples

Imagine a beginner named Sara who earns a monthly salary. She lists her fixed expenses like rent and utilities, then estimates variable costs like groceries and transport. After that, she allocates a small portion to savings. This simple structure helps her avoid overspending and ensures she always knows where her money is going.

Another example is Ali, who uses a mobile expense tracker. By reviewing weekly spending patterns, he realizes he spends more on food delivery than expected. He adjusts his habits and saves that money instead. This is a practical application of awareness-based money management.

Common Money Management Mistakes Beginners Make

- Not tracking expenses

- Ignoring small daily spending

- Relying too much on credit cards

- Not building an emergency fund

- Following financial trends without understanding them

- Mixing needs with wants

These mistakes usually happen due to lack of awareness, not lack of intelligence. The good news is that all of them can be corrected with consistent learning and small habit changes.

Tips and Best Practices for Better Money Management

- Start with simple budgeting methods

- Pay yourself first by saving before spending

- Review finances weekly or monthly

- Use financial tools or apps for tracking

- Set realistic financial goals

- Learn basic financial literacy terms

- Separate emergency savings from daily accounts

Money management improves gradually. You do not need to master everything at once. Even small positive steps create long-term benefits.

The Role of Financial Awareness and Behavior

Money management is not only about numbers. It is also about behavior. Emotional spending, social pressure, and impulse buying can easily disrupt financial plans. Understanding your personal spending triggers helps you make more balanced decisions.

For instance, someone who shops when stressed can replace that habit with a free activity like walking or reading. This behavioral shift supports healthier money management without feeling restrictive.

Money Management vs. Financial Freedom

Money management does not guarantee wealth, but it increases financial stability. Financial freedom is not about earning millions. It is about having control, flexibility, and reduced financial pressure. Good money management is the pathway that makes this possible.

Short Disclaimer

This content is for informational purposes only and should not be considered financial advice.

Conclusion

Money management is a lifelong skill that empowers you to take control of your financial future. By understanding basic concepts like budgeting, saving, spending control, and financial planning, beginners can build a strong foundation for long-term stability. The goal is not perfection but consistency. Every small improvement in how you manage money brings you closer to confidence, security, and peace of mind.

Frequently Asked Questions

What is the simplest definition of money management?

Money management is the process of planning and controlling how you earn, spend, save, and use your money.

Why is money management important for beginners?

It helps beginners avoid debt, reduce stress, and build healthy financial habits early.

Can money management improve financial stability?

Yes, good money management supports better control, preparedness, and long-term financial balance.

Is budgeting necessary for money management?

Budgeting is a core part of money management because it organizes income and expenses clearly.

How can I start managing my money today?

You can start by tracking expenses, setting a small savings goal, and reviewing your spending weekly.