Creating a monthly budget is one of the most practical skills you can learn for managing money with confidence. If you’re new to budgeting, the idea might feel overwhelming at first. You may wonder where to start, what to include, or how strict a budget should be.

The good news is this: a monthly budget does not need to be complicated. With a clear process and realistic expectations, anyone can build a simple system that helps them understand their spending, plan ahead, and reduce financial stress.

This beginner-friendly guide explains how to create a monthly budget step by step, using clear language, real-life examples, and proven financial concepts—without jargon or unrealistic promises.

What Is a Monthly Budget?

A monthly budget is a plan for how your money will be used over one month. It compares your income with your expenses so you can decide, in advance, where your money should go.

Instead of wondering where your salary disappeared, budgeting helps you:

- See your cash flow clearly

- Control everyday spending

- Prepare for upcoming bills

- Align money with your priorities

At its core, budgeting is about awareness and intention, not restriction.

Why Beginners Should Start Budgeting Early

Many people delay budgeting because they think it’s only for those with high incomes or financial problems. In reality, beginners benefit the most from learning this habit early.

A simple monthly budget can help you:

- Avoid overspending without realizing it

- Build a healthier relationship with money

- Reduce anxiety around bills and expenses

- Make room for savings, even with a modest income

Budgeting works best when it becomes a routine, not a one-time fix.

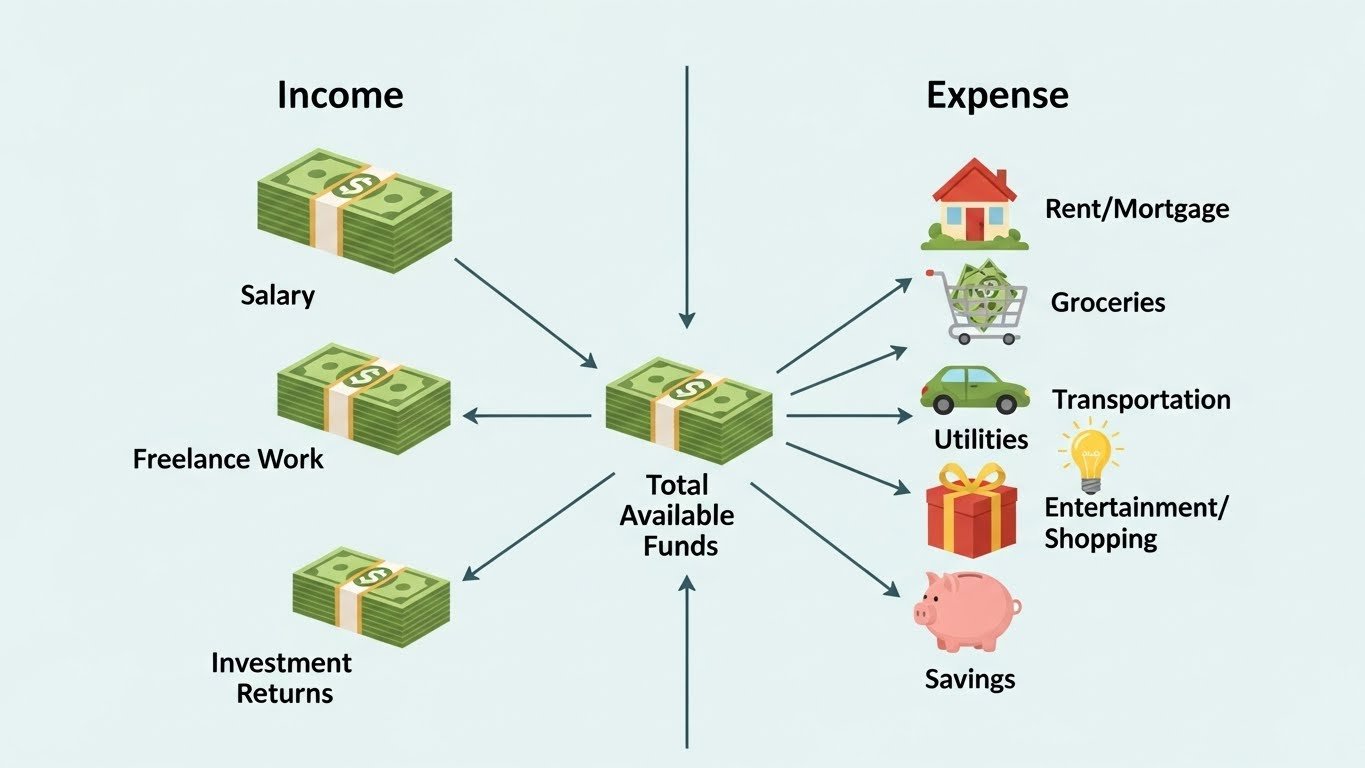

Step 1: Calculate Your Monthly Income

The first step in creating a budget is knowing how much money comes in each month.

What to include as income

- Salary or wages (after tax, if possible)

- Freelance or side income (average amount)

- Allowance or support you receive regularly

If your income changes month to month, calculate an average based on the last three to six months. This gives a more realistic starting point.

Tip: Always use conservative estimates. It’s easier to adjust upward than to fix a shortfall later.

Step 2: List All Monthly Expenses

Next, write down everything you spend money on during a typical month. This step builds financial awareness, which is essential for effective budgeting.

Fixed expenses

These costs stay mostly the same each month:

- Rent or mortgage

- Utilities

- Internet or phone bills

- Insurance payments

Variable expenses

These can change from month to month:

- Groceries

- Transportation

- Dining out

- Personal care

- Entertainment

Irregular expenses

Often forgotten, but very important:

- Annual subscriptions

- Medical costs

- Gifts or celebrations

- Maintenance or repairs

By including irregular costs, your monthly budget becomes more realistic and less stressful.

Step 3: Categorize Your Spending

Organizing expenses into categories makes patterns easier to spot.

Common budgeting categories include:

- Housing

- Food

- Transportation

- Utilities

- Personal spending

- Savings

- Miscellaneous

You don’t need perfect categories. The goal is clarity, not perfection.

Step 4: Choose a Budgeting Method That Fits You

There is no single “best” budgeting method. Different frameworks work for different personalities and lifestyles.

The 50/30/20 budget rule

This popular approach divides income into:

- 50% for needs

- 30% for wants

- 20% for savings or debt repayment

It’s flexible and easy to understand, making it suitable for beginners.

Zero-based budgeting

With this method, every dollar is assigned a purpose:

- Income minus expenses equals zero

- Savings are treated like an expense

This approach encourages intentional spending but requires more attention.

Envelope-style budgeting

You allocate spending limits to categories:

- Physical envelopes or digital equivalents

- Helps control variable expenses

Choose a method that feels manageable. Consistency matters more than complexity.

Step 5: Set Realistic Spending Limits

A common beginner mistake is setting overly strict limits. This often leads to frustration and quitting.

Instead:

- Start with your current spending habits

- Reduce gradually, not suddenly

- Allow room for flexibility

For example, if you usually spend a certain amount on food, aim for a small reduction rather than a drastic cut.

Budgeting is about progress, not punishment.

Step 6: Include Savings in Your Monthly Budget

Saving money becomes easier when it’s part of the plan.

Even small amounts matter:

- Emergency fund contributions

- Short-term goals

- Long-term financial security

Treat savings like a regular bill you pay to yourself. This mental shift encourages consistency.

Step 7: Track Your Spending Throughout the Month

A budget only works if you track actual spending.

You can track expenses using:

- A simple notebook

- A spreadsheet

- A basic budgeting app

The method doesn’t matter as much as the habit. Check your spending weekly to avoid surprises at the end of the month.

Common Budgeting Mistakes Beginners Should Avoid

Understanding common pitfalls helps you stay on track.

Being too strict

Overly tight budgets are hard to maintain and often lead to burnout.

Forgetting irregular expenses

Annual or occasional costs can derail a monthly plan if ignored.

Not reviewing the budget

Life changes, and your budget should adapt with it.

Expecting perfection

Budgets improve with time. Mistakes are part of the learning process.

How to Adjust Your Budget Over Time

A monthly budget is a living document. Review it at the end of each month and ask:

- What worked well?

- Where did I overspend?

- What needs adjustment next month?

Small tweaks lead to better accuracy and confidence over time.

Simple Example of a Beginner Monthly Budget

Here’s a basic illustration:

- Monthly income: planned amount

- Housing and utilities: planned portion

- Food and groceries: reasonable allocation

- Transportation and personal expenses: flexible range

- Savings: modest but consistent

The exact numbers will vary, but the structure stays the same.

How Budgeting Supports Better Financial Habits

Over time, budgeting helps build:

- Financial discipline

- Mindful spending habits

- Clear financial priorities

It also supports related topics like:

- Emergency fund planning

- Debt management basics

- Long-term goal setting

These areas can be explored as next steps once your monthly budget feels comfortable.

Final Thoughts

Learning how to create a monthly budget as a beginner is a powerful step toward financial clarity. You don’t need advanced tools, complex formulas, or perfect discipline. You need a simple plan, honest tracking, and patience with yourself.

Start small, stay consistent, and allow your budget to evolve with your life.

This content is for informational purposes only and should not be considered financial advice.

With time, budgeting becomes less about numbers and more about confidence, control, and peace of mind.