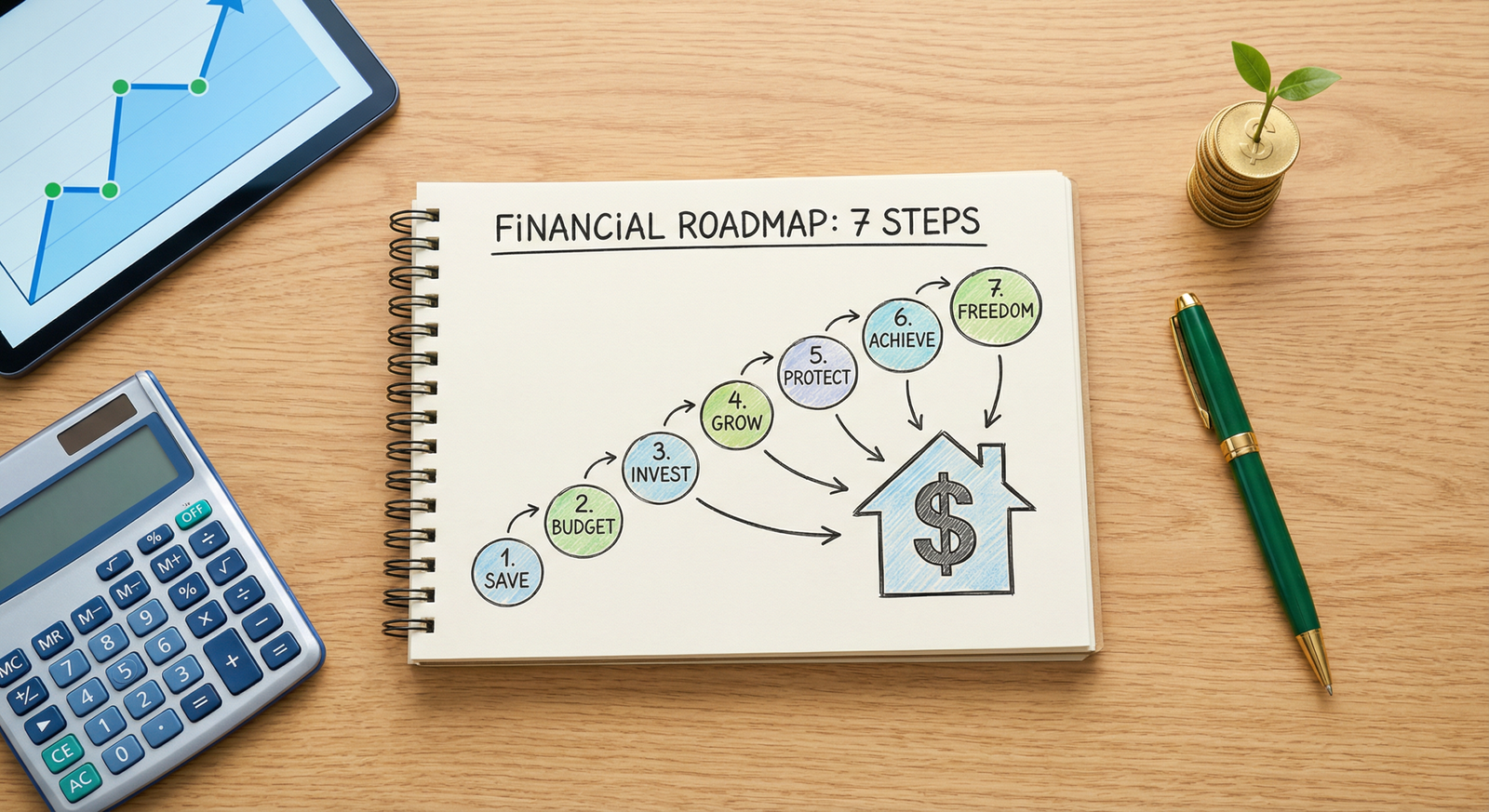

Financial planning is a comprehensive strategy that helps individuals determine how to manage money to achieve life goals and secure financial stability. This process involves evaluating current income, expenses, debts, and savings to create a roadmap for the future. A solid financial plan covers essential areas such as budgeting, insurance, investment strategies, and retirement preparation. By organizing these elements, individuals can reduce monetary stress and make informed decisions about wealth accumulation.

- Financial planning creates a roadmap for your money to achieve specific life goals.

- Effective plans require tracking cash flow, managing debt, and building emergency savings.

- Establishing SMART goals helps prioritize spending and saving efforts.

- Investing early allows compound interest to grow wealth over time.

- Regular reviews ensure the plan adapts to life changes and economic shifts.

What Is Financial Planning?

Financial planning is the ongoing process of looking at your entire financial picture to create strategies for achieving short and long-term goals. This practice goes beyond simple budgeting to include tax planning, estate planning, and risk management. What is financial planning and why it matters is a fundamental question for anyone looking to improve their economic health. The primary objective is to ensure that current assets are utilized effectively to meet future needs.

Many beginners assume financial planning is only for the wealthy. However, everyone benefits from a plan. A clear strategy helps people with limited resources prioritize needs over wants and find ways to save. Without a plan, financial decisions often become reactive rather than proactive, leading to missed opportunities for growth.

Why Is Financial Planning Important?

Financial planning is important because the process provides direction and meaning to financial decisions. When a person understands how each dollar contributes to a larger objective, spending habits improve. This clarity allows individuals to prepare for unexpected expenses without derailing long-term progress. Furthermore, having a plan helps mitigate the impact of inflation and economic downturns.

Key benefits include:

- Increased Savings: Specific targets encourage consistent saving habits.

- Better Standard of Living: Strategic planning balances current enjoyment with future security.

- Financial Independence: Proper asset management reduces reliance on employment income over time.

- Peace of Mind: Knowing that emergency funds and insurance are in place reduces anxiety.

Step 1: Set Clear Financial Goals

Setting financial goals involves identifying specific objectives you want to achieve with your money within a set timeframe. These objectives act as the foundation of the entire financial plan. Goals must be specific, measurable, achievable, relevant, and time-bound (SMART). Differentiating between immediate needs and future aspirations is critical during this stage.

You must categorize these targets. Short-term vs long-term financial goals explained in detail helps clarify where to focus energy first.

Types of Financial Goals

| Goal Category | Timeframe | Examples |

|---|---|---|

| Short-Term | 0–1 Years | Building an emergency fund, minor car repairs, holiday gifts. |

| Medium-Term | 1–5 Years | Down payment for a house, paying off credit card debt, wedding costs. |

| Long-Term | 5+ Years | Retirement savings, children’s education funds, paying off a mortgage. |

Step 2: Track Your Money and Budget

Budgeting is the tactical application of a financial plan where you track income versus expenses to ensure you live within your means. You cannot plan for the future if you do not know where money goes today. A budget reveals spending leaks and highlights areas where cash flow can be redirected toward savings or debt repayment.

For those new to this process, learning how to create a monthly budget for beginners is the first actionable step. Several methods exist, such as the 50/30/20 rule, which allocates 50% of income to needs, 30% to wants, and 20% to savings. Alternatively, the zero-based budget assigns every dollar a job before the month begins. Using best free budgeting tools for beginners can automate this tracking and reduce manual errors.

Common expenses to track include:

- Fixed Expenses: Rent, mortgage, car payments, insurance premiums.

- Variable Expenses: Groceries, utilities, entertainment, dining out.

- Irregular Expenses: Car maintenance, medical co-pays, annual subscriptions.

Step 3: Build an Emergency Fund

An emergency fund is a dedicated savings account set aside to cover unforeseen financial expenses without relying on credit cards or loans. Financial experts generally recommend saving enough to cover 3 to 6 months of essential living expenses. This safety net protects other investments and keeps debt levels low when emergencies occur.

Start small if necessary. Setting aside $500 to $1,000 provides a buffer against minor issues like a flat tire or a broken appliance. Once that baseline is established, focus on expanding the fund to cover full months of expenses. To speed up this process, explore simple ways to save money such as cutting unused subscriptions or negotiating lower bills. This liquidity provides the stability required to take investment risks later.

Step 4: Manage and Reduce Debt

Debt management is the strategy of controlling and paying off liabilities to reduce interest costs and free up future income. High-interest consumer debt, such as credit card balances, hinders wealth creation because interest payments compound against the borrower. A successful financial plan prioritizes the elimination of toxic debt.

Two popular strategies for debt reduction include:

- Debt Avalanche: Pay minimums on all debts, then attack the debt with the highest interest rate. This method saves the most money mathematically.

- Debt Snowball: Pay minimums on all debts, then attack the smallest balance. This method builds psychological momentum.

Understanding needs vs wants and how to control your spending is crucial during the debt payoff phase. Every dollar not spent on discretionary items can accelerate debt freedom. For reliable information on managing debt, refer to the Consumer Financial Protection Bureau.

Step 5: Plan for Taxes and Insurance

Risk management involves using insurance and tax strategies to protect assets and minimize liabilities. Insurance transfers the financial risk of catastrophic events—such as health issues, car accidents, or premature death—to an insurance provider. Without adequate coverage, a single event can wipe out years of savings.

Essential insurance types often include:

- Health Insurance: Covers medical costs.

- Auto Insurance: Protects against vehicle damage and liability.

- Life Insurance: Provides for dependents in the event of death.

- Disability Insurance: Replaces income if an injury prevents work.

Tax planning is equally vital. Utilizing tax-advantaged accounts like 401(k)s or IRAs reduces taxable income today while building retirement savings. Understanding how taxes impact investment returns ensures you keep more of what you earn.

Step 6: Invest for the Future

Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit over time. While saving preserves money, investing grows it to outpace inflation. To understand the basics, read about what is money management and beginners guide to smart finances.

Beginners should focus on diversified portfolios to manage risk. Index funds and Exchange Traded Funds (ETFs) offer broad market exposure with lower fees compared to actively managed funds. The power of compound interest means that starting early is often more important than starting with large sums.

Asset Classes Overview

- Stocks: Ownership shares in a company. High potential growth, higher risk.

- Bonds: Loans to governments or corporations. Lower risk, steady interest income.

- Cash Equivalents: Money market funds or CDs. Very low risk, lower returns.

- Real Estate: Physical property. Provides rental income and potential appreciation.

For authoritative data on investment basics, consult Investor.gov.

Step 7: Estate Planning

Estate planning is the preparation of tasks that serve to manage an individual’s asset base in the event of their incapacitation or death. This step ensures that assets are distributed according to the individual’s wishes rather than state laws. It includes creating wills, setting up trusts, and naming beneficiaries for financial accounts.

Many people neglect this step, thinking it is only for the elderly. However, having a will and designated power of attorney is essential for any adult with assets or dependents. This preparation prevents legal complications and family disputes during difficult times.

Common Financial Planning Mistakes

Financial planning mistakes are errors in judgment or behavior that delay goal achievement or result in monetary loss. Recognizing these pitfalls helps beginners avoid setbacks. One frequent error is delaying the start of the planning process. Waiting for a “perfect” financial situation often results in lost years of compound growth.

Other common errors include:

- Ignoring Inflation: Failing to invest allows inflation to erode purchasing power.

- Lifestyle Creep: Increasing spending immediately as income rises instead of saving the difference.

- Emotional Investing: Selling investments during market dips out of fear.

- No Emergency Fund: Relying on credit cards when unexpected costs arise.

Review 10 common budgeting mistakes and how to fix them to ensure your daily habits align with your broader financial plan.

Conclusion

Financial planning is not a one-time event but a lifelong process that adapts to your changing circumstances. By setting clear goals, creating a budget, managing debt, and investing wisely, you build a foundation for lasting security. The most important step is simply to begin. Start with a budget today, establish your emergency fund, and gradually expand your knowledge of investing. Taking control of your finances now ensures a more stable and prosperous future.

Frequently Asked Questions

Is financial planning only for rich people?

No, financial planning is essential for everyone regardless of income level. Creating a plan helps individuals with lower incomes manage cash flow, reduce debt, and build savings for the future.

Do I need a financial advisor to create a plan?

No, you do not strictly need a professional advisor to start a basic financial plan. Many beginners can successfully manage budgeting, saving, and index fund investing using self-education and digital tools.

When should I start financial planning?

You should start financial planning immediately. The earlier you begin managing your money and investing, the more time your assets have to grow through compound interest.

How much does a financial plan cost?

A self-made financial plan costs $0 and requires only time and effort. If you hire a professional financial planner, costs can range from $1,000 to $3,000 for a comprehensive plan or an hourly fee of $200 to $400.

What is the 50/30/20 rule in financial planning?

The 50/30/20 rule is a budgeting method where 50% of income goes to needs, 30% to wants, and 20% to savings and debt repayment. This framework simplifies allocating income for beginners.