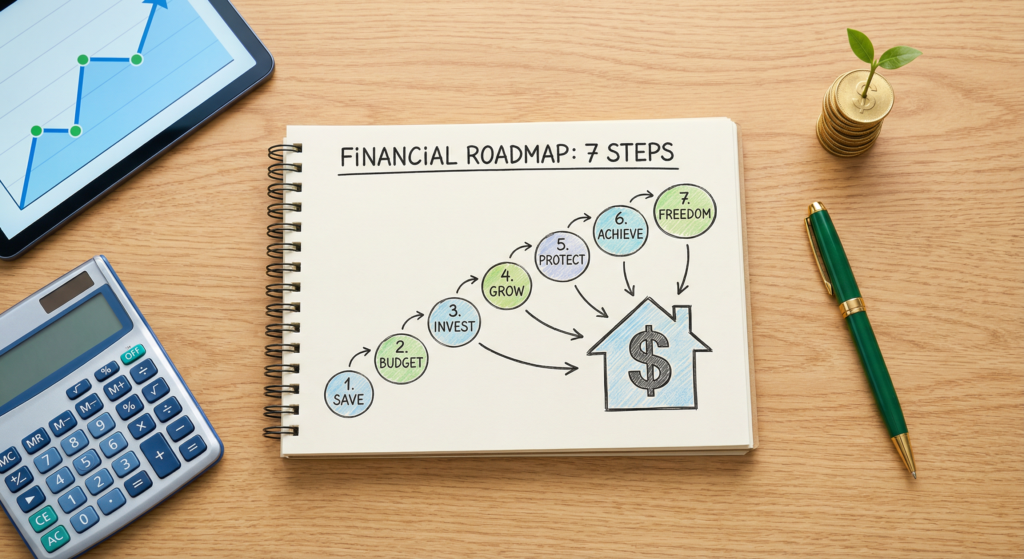

How to Invest Money: 7 Steps for Beginners (2026 Guide)

Investing money is the process of purchasing assets that increase in value over time to build wealth and achieve financial goals. Learning how to invest money is essential for beating inflation and securing a stable financial future. While the stock market can seem intimidating, the fundamental principles of investing are accessible to everyone regardless of […]

How to Invest Money: 7 Steps for Beginners (2026 Guide) Read More »