Budget Spreadsheet: 10 Best Free Templates for 2026 [Guide]

A budget spreadsheet is a digital tool used to organize income, track expenses, and calculate net savings over a specific period. By utilizing a budget spreadsheet, individuals can gain a granular view of their financial health, ensuring that every dollar is allocated toward essential needs, debt repayment, or long-term wealth building. This manual approach to […]

Budget Spreadsheet: 10 Best Free Templates for 2026 [Guide] Read More »

![Budget Spreadsheet 10 Best Free Templates for 2026 [Guide]](https://moneyfoundations.com/wp-content/uploads/2026/02/Budget-Spreadsheet-10-Best-Free-Templates-for-2026-Guide-1024x559.jpeg)

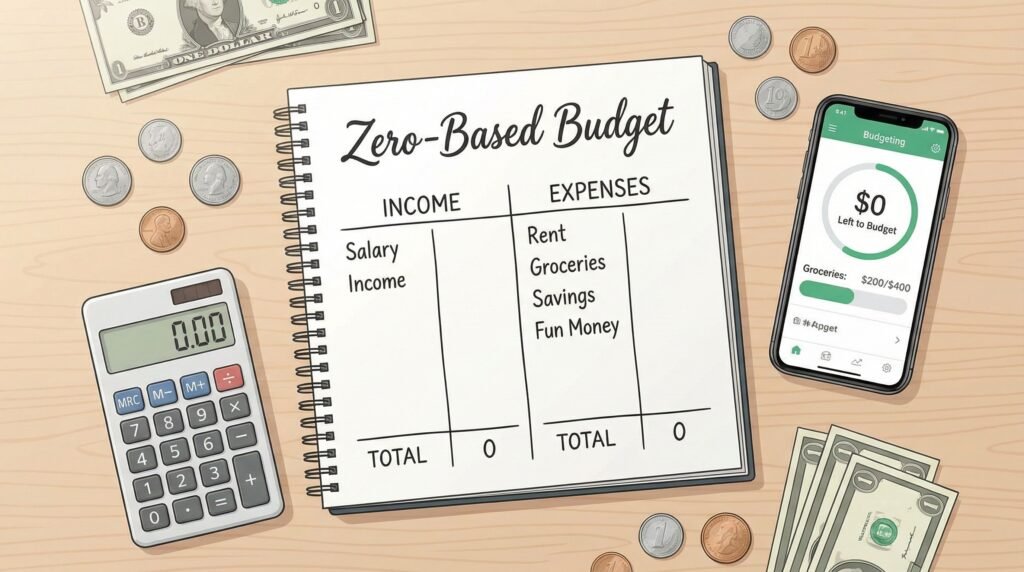

![Best Budget App 2026 Top 7 Tools for Beginners [Review]](https://moneyfoundations.com/wp-content/uploads/2026/01/Best-Budget-App-2026-Top-7-Tools-for-Beginners-Review-1024x559.jpeg)