Best Budget App 2026: Top 7 Tools for Beginners [Review]

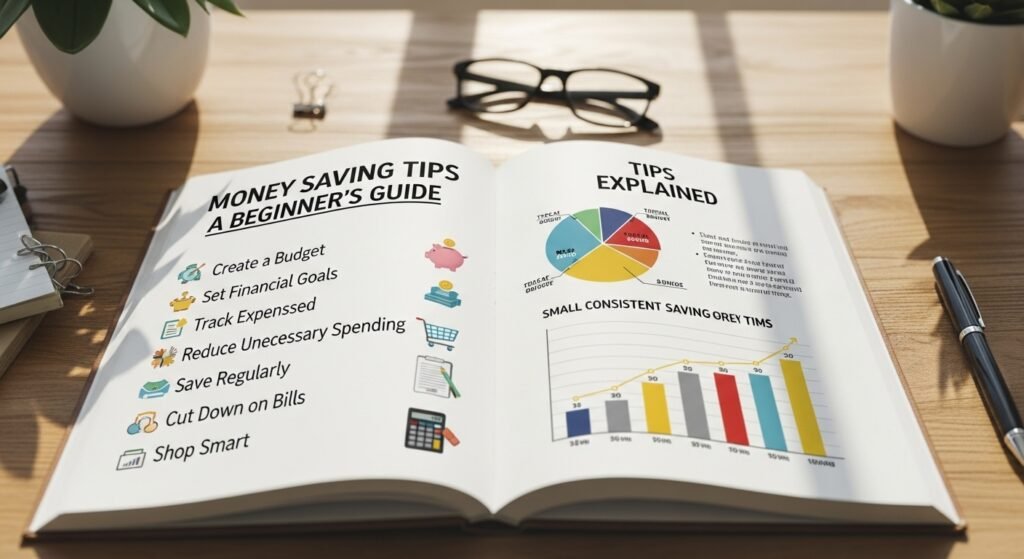

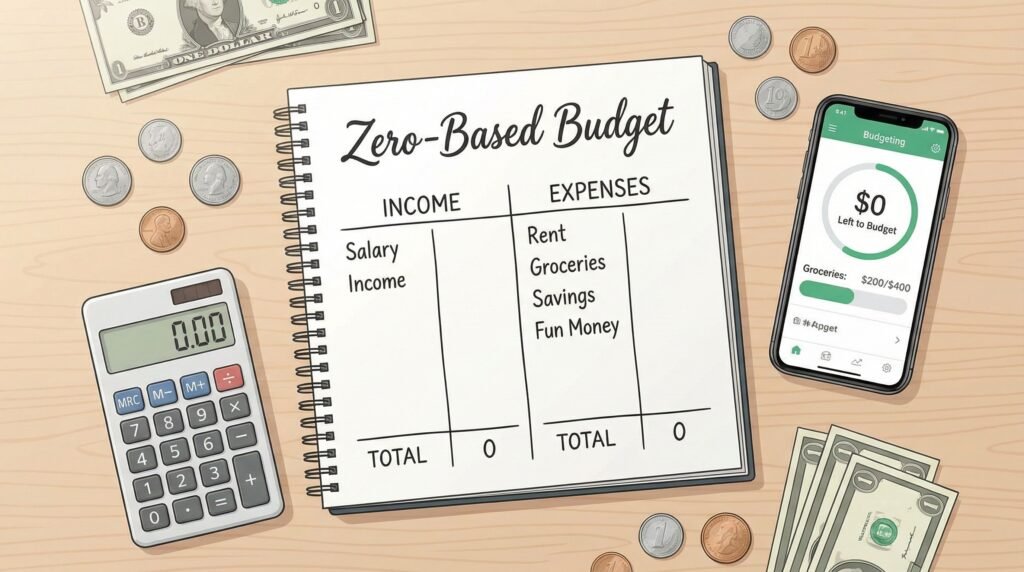

A budget app is a software application designed to track income, categorize expenses, and monitor financial goals via mobile or desktop devices. These digital tools replace traditional spreadsheets and paper ledgers by syncing directly with bank accounts to provide real-time financial data. For beginners learning how to create a monthly budget, these applications serve as […]

Best Budget App 2026: Top 7 Tools for Beginners [Review] Read More »

![Best Budget App 2026 Top 7 Tools for Beginners [Review]](https://moneyfoundations.com/wp-content/uploads/2026/01/Best-Budget-App-2026-Top-7-Tools-for-Beginners-Review-1024x559.jpeg)